Open Banking/Finance:

How customer data and digital identity creates better and personalized experiences

There is continued discussion in financial services circles about open banking, open finance, and customer portable data. However, I have noticed a few things: 1) there are differing views within the financial services community on what each of these things and 2) people outside of financial services lack an understanding not only of open banking is but most importantly how it will continue to spur innovation and improve their financial well-being.

The simplest definition is that open banking has the sole aim of giving consumers power over their own financial data. That’s it. But that simplifying it to that one sentence does not show the magnitude of radical changes open banking will continue to bring to the sector as a result of access to and portability of financial data.

Here is an attempt to start to explain these concepts and to help demonstrate current innovations and not so distant future use cases.

A brief history of open banking: Why and how did it start?

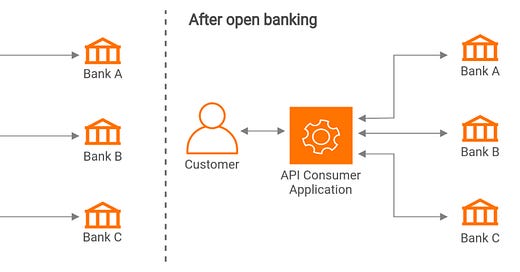

First, let’s have some background. Historically, banks were walled gardens where data did not leave. They viewed that data as their own and not their customers. This made it difficult for customers to go to a new bank or to apply for products outside of their primary banking relationships. Then in 2007, key pieces of European legislation laid the foundation for open banking (I’m not going to get into the details on these but it’s worth looking up a history on Payment Service Providers Directive (PSD) and the subsequent amendment (PSD2) as well as some other European based regulations). Through these pieces of legislation there was the promotion of innovation and competition around payments, requirements on fee transparency, a requirement that banks release customer data in a secure fashion upon consumer request, the broad adoption of Application Programming Interfaces (APIs) as the mechanism by which third parties could securely gather the data from Financial Institutions, and also requirements around data format standardization for easily sharing the data between financial institutions or with third parties.

As you might imagine, this had many banks worried that it would make it extremely easy for customers to switch banks and potentially lead to constant switching (it hasn’t turned out to be true and I think there are both major advantages brick and mortar banks have as well as many existing barriers, like payments, that hold customers to their primary bank). If I can bring my financial history with me, why wouldn’t I shop for the best rates on every product. Think about a simple analogy of when cell phone carriers owned a set of phone numbers. If you wanted to switch from AT&T to Verizon, you could not take that phone number with you. Instead, you’d have to get a new phone number and let all your friends know of your new numbers. Now, you’re able to port that phone number with you as you please. In the open banking context, the reality has been that primary bank relationships are much “stickier” than switching cell phone providers (for now).

While the legislation mentioned was in Europe it paved the way for worldwide innovation. The initial benefits of open banking were fairly simple and straight forward, following the desired goal of creating innovation by new players within spaces traditionally dominated by banks. Instead of interacting directly with your bank of choice, consumers could now interact with their third party provider of choice. From there, consumers started to see more innovation including easier direct payments, as an example embedded payment experiences in an ecommerce site. From a customer perspective, having all of their financial data in one place equals ease of use as well as monitoring their financial health. For their fintech or bank partner, it should mean the ability to provide more personalized service and advice to the consumer as they have the complete financial picture. For the potential of new products or services, having access to all financial data should mean faster and better account opening or credit decisioning processes.

Wave 1 Innovation: Basic Aggregation

Account Aggregators: If you want an aggregated view of all of your banking and fintech data, you’ve used an aggregator. They are the pipes that pull users’ financial data from banks so that they can be presented in a singular dashboard view. Some examples of companies in this space include Plaid, Finicity, Yodlee, and MX. While they all started with the main solution of pulling financial data, as with many other open banking companies they see opportunities to expand into other areas including authentication, identity verification and know your customer, provide snapshots of assets and liabilities, and more.

Business Accounting: Companies like Xero, Sage, Wave, and QuickBooks allow customers to connect their bank accounts to import transaction data and streamline the accounting process for small businesses, speed up payments (account to account payments), manage cash flow, and more.

Personal Finance Management (PFM): Mint is a prime example of this space. They pull in all of a users’ account information from their variety of banking relationships (checking and savings accounts, investment accounts, credit cards, other loan vehicles, etc.) and put it into one place to give you a complete financial picture. These PFM tools help with establishing a budget and provide additional insights on personal cashflow and help predict if you are going to be above/below budget for a month

Subscription and Bill Monitoring: A natural growth point beyond PFM was to monitor recurring subscription and bill expenses to look for growing fees or unused products and services. These companies look at financial data, can identify the subscriptions that a user has, identify which subscriptions they are overpaying for, and sometimes even help with negotiating those rates down. There are many companies in this space including Mint (an added service from their original value prop), Rocket Money (acquired Trubill), Subaio, ApTap, Bud, BillShark, and Trim to name a few.

Wave 2 Innovation: Process improvement through data expansion

As is typical with innovation, there has been a ballooning of new financial data points to leverage, build insights off of, and new products and service to be created in tangential areas. Much like with the basic financial transaction data, there is a huge need to safely and securely transport customer data from various financial and non-financial centers. I’ll go into several examples below but let’s start with the mortgage application process.

You need to gather a lot of documents and information: government issued identification, verification of income and employment, a list of your assets and debts, a credit history, your rental history, and more. In the traditional application and underwriting process, you’d submit each of these items via paper copy. If you were applying with multiple lenders, you’d create copies of each of these documents for each application. For the lenders, they needed a way to receive and keep track of all of this paper. But they also need to be able to verify that it is a verified source (just google “paystub” and you’ll see that 7 out of the first 9 hits are for “paystub generators”). Now with open banking and the continued innovation in the movement of personal data, every piece of information in this application flow can be in digital form, taken directly from a verifiable source, and all be permissioned at the direction of the applicant. There are many companies leading in this space but let’s take Truv as an example. They started with the problem of Employment/Income Verification, which had multiple pain points in the traditional model: expensive to go through legacy players along with constantly increasing prices, have to pay for every report request also adding to the expense, slow turnaround time dragging out the application process, and high risk of fraud without a secure way to pass the information.

By creating APIs directly with the thousands of payroll providers out there (not an easy task!), Truv is able to speed up the application process, verify the authenticity of the data source and the data within the reports, and provide continuous monitoring for any information that may change and indicate an applicant may be likely to default on a loan.

Even this space opened the door for further tangential innovation off of payroll data. Payroll data can provide a lot of insights into not only the money an individual is earning but also where a lot of that money is going.

(side note: if you want a good listen on this particular space, check out Jason Mikula’s Fintech Business Weekly podcast interview with Kurt Lin, Founder of Pinwheel)

Are they getting extra money this cycle from overtime or working extra jobs, are they contributing to a retirement account, is their direct deposit being split among multiple bank accounts, are they on leave and there is an opportunity to reach out to the customer at a life event? The result of the access to this information along with read and write access to payroll systems is the explosion of tangential innovation with key capabilities like

Direct Deposit Switching, Earned Wage Access offerings, Income Based Lending, alternative data inputs for credit decisioning, identity verification, and more.

Here are just a few additional innovations that are empowered because of open banking.

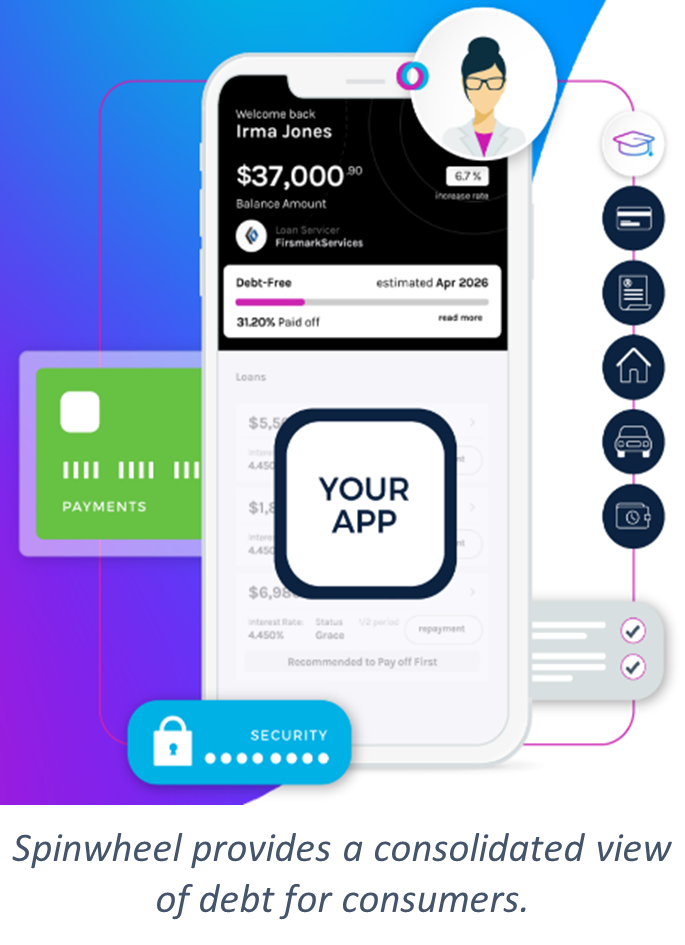

Debt consolidation: In the world of lending, most consumers are looking for the best possible rate, which often isn’t with their primary bank. Debt is such an important part of consumers’ financial health that there must be insight into the principal outstanding along with an understanding of the payback terms to help guide in the most sensical payback strategy. Companies like Spinwheel help solve this problem by helping banks and fintechs create a consolidated view of debt for their customers.

Instant Credit Risk and BNPL: Buy Now Pay Later has received a These lot of publicity over the past few years. It is a great example of the power of open banking providing instance and continuous access to data. By being able to have access to the complete financial picture of a customer, lending decisions can be made instantaneously at point of sale regarding specific items being purchased. Companies in this space include Klarna, Afterpay, Zip Pay.

Small Business Finance and Operations Aggregation: The average small business uses several applications or services to run their business. There are many that are financial in nature like accounting software, inventory management, merchant services, bill pay, payroll, and more. They also use a long list of non-financial services like marketing, website trackers, logistics, CRM tools, and more. Aggregating data across the variety of these sources to create a centralized dashboard and a list of key metrics and can show the correlation between previously disconnected actions (e.g., your marketing campaign resulted in sales of widget A and a decreased inventory. Consider purchasing extra of widget A before the next campaign).

Credit Scores: Credit scores have traditionally been held by the credit bureaus, only taking into consideration certain data points to create the score. Now with access to lots of different data sources and payment information we’ve seen more creative ways to help people establish credit: debit cards to build credit like Extra and Sequin, companies like Nova Credit pull and standardize international credit sources to create a US equivalent score, leveraging recurring payments not previously considered like rent, creation of short term loans to build credit, and more. We’ve even seen the credit bureaus leverage alternative data to help people increase their scores with the creation of things like Experian Boost.

Tax Management: Combined with the explosion of the Gig Economy, there are many people earning a significant portion of their income from 1099 type work. A significant pain point is how to estimate and pay tax obligations. With real time access to payroll data, ability to track mileage, upload business receipts and more, companies like Hurdlr and Coconot make the arduous task of paying taxes less burdensome.

Current US Regulatory Environment and Future Innovation

Now, years later after all of this innovation in open banking, we’re finally seeing the potential for US regulations with the most notable being Regulation 1033 of the Dodd Frank act. We’ll have to wait and see what is in the final version but early indications is that it will not include all of the financial data we’ve outlined in the above examples. It will also be very interesting to see if the regulation creates a level playing field for FIs, Aggregators, and FinTechs.

I believe that we’ve only scratched the surface of what experiences open banking can drive. It’s our job in the fintech community to continue to describe this progression of open banking and to explain it to the non-fintech nerds that are growing their business or advancing their financial lives. When we ask them if they’re willing to share their data or participate in open banking, it must be accompanied by these examples to show why they should not only consider it but be begging for it, understanding that they own their data and are empowered with these extra experiences.

So tell me fintech community, what obvious examples of Open Banking have I left out? What are some great companies that deserve to be highlighted, showcasing how they are improving consumers’ lives through open banking technology? In the coming weeks I’ll start to do deeper dives in various technologies that are improving current pain points and improving financial health for individuals.

Reading Recommendations

More on CFPB and Reg 1033 from Nik Milanovic and Nate Soffio: This Week in Fintech

Rising Interest Rates: The rise in interest rates has been well documented but I’ve noticed a lot of people talking about it, including several articles by the Wall Street Journal. Rich customers pull money from banks offering paultry interest rates

Chat GPT: Some great insights into how ChatGPT can impact Financial Services

Simon Taylor’s Fintech Brain Food: The Co-Pilot Revolution: How ChatGPT Changes Fintech

Alex Johnson’s Fintech Takes: The most intriguing (and terrifying) fintech use case for generative AI

Francisco Javier Arceo’s Chaos Engineering: ChatGPT Learns Fintech

US Trends: I’ve been researching US Census data as well as family trends for a while now. I’ll share more detailed insights at a later date but one article struck me this week. WSJ More parents are moving in with their adult children