FinTech Innovation Issue #4: 2024 Predictions:

Consumer debt, Real Time Payments, Generative AI and more.

Thank you for coming to Fintech Innovation where I do my best to describe fintech topics of interest to me, where I see future innovation opportunities, and other business related topics. Please consider subscribing or sharing with your friends as your support is very appreciated!

Spaces and companies to watch:

Happy New Year! 2023 saw a ton of great innovation in the Fintech and broader technology spaces. With this new year just getting started, here are some things that I’m watching this year.

Interest rates, consumer debt, and impacts on banking: Interest rates have been a hot topic really since 2022. The Fed continued raising rates throughout last year in an attempt to cool inflation coming out of the pandemic. It seems that the desired “soft landing” might actually happen but that doesn’t mean that there haven’t been impacts to consumer spending. Sales of bigger ticket items like homes and cars have generally slowed, household credit card debt increased, and don’t forget about student loan interest and bills starting again late last year. Rising interest rates can also present positives for the consumer as their are higher interest yielding savings accounts available. Both sides of this equation presents opportunities for Fintechs / FIs to help their customers.

BNPL will continue to rise in consumer popularity: Consumer debt continued to increase the back half of 2023. While there may be a soft landing predicted for 2024, consumers have increase credit card usage as well as BNPL lending options.

However, the space is getting incredibly crowded and competitive with over 200 companies in the space, Banks entering as well, as well as big tech with Apple’s offering. I understand why Merchants love BNPL, with the 20%-30% increase in conversion and think the space will continue to grow significantly in 2024. However, I still am not a fan of this lending mechanism for the mass consumer unless they are able to afford it and track their payments (debt consolidation!).

Debt consolidation space will grow: With student loans coming back, an increase in usage of credit cards to fund daily life, and continued BNPL growth, companies like Spinwheel could be very useful for FIs and their consumers. Spinwheel makes it easy for FIs to facilitate the digital consolidation of debt into the FI app. It also helps to optimize the debt payments, helping customers save money. For FIs, you have the opportunity to increase deposits and get better insights into your customers’ complete financial picture. I think this space is slightly different from traditional D2C PFM, especially since it combines lending and deposits into one.

Deposits and Payment Switching will increase: With higher interest rates brings opportunities to attract new deposits. While direct deposit switching technology exists, it’s not the hardest part of attracting new customers and getting them to engage (aka make payments!). The hardest part is switching the payments. Look for companies like Knot to continue their growth this year.

Real Time Payments will become more prevalent: There was big growth in The Clearing House Real Time Payments (RTP) and FedNow’s rival product (payments dive offers some interesting growth statistics). This space will be interesting to watch as I think consumers don’t really care about underlying rails. They do want their money to travel instantly when they really need it for higher dollar spending. I think the biggest consumer growth will take place with high net worth individuals trying to move larger sums of money. Outside of that, daily consumers won’t care too much. My biggest concern with faster payments is the potential for faster fraud.

Fraud will persist: As long as there is money and banks, there will be Fraud. Unfortunately, not only are there many different types of fraud that effect consumers, FinTech, and FIs but the way fraudsters act and attack isn’t stagnant but shifts as behaviors change.

Big winners in this space will be those that can combine device fingerprinting with biometrics in a seamless way - prove that you are who you say you are and that you are in possessions of the device performing money movement. This is also a great space for AI to help monitor and automate.

AI usage will increase: There are so many use cases for AI in finance that this seems like too easy of a prediction. Fraud (already mentioned), servicing and chatbots (big banks already have this but it’s becoming easier to create your own chatbots as a small company, for customers, etc.), process automation, empowering workforce to gain time-efficiencies, credit-decisioning, and so much more. I’m especially excited to see how non-AI focused companies leverage AI to become more efficient or expand their offerings.

One fun thing:

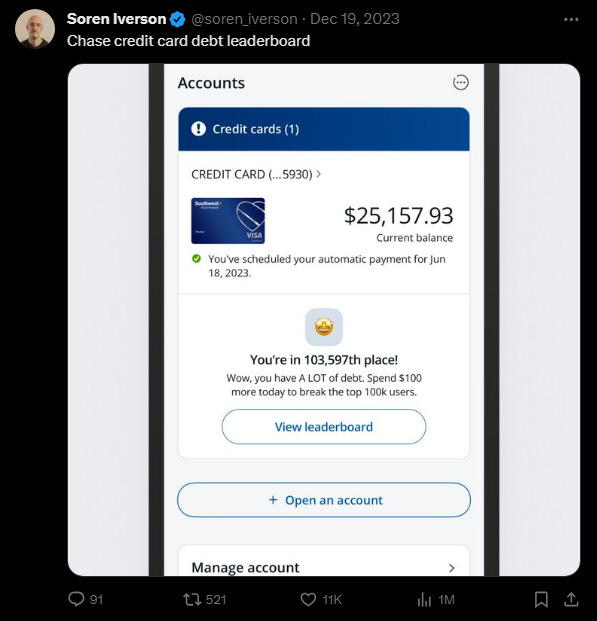

This is a great account to follow for funny design ideas. Soren did one idea every day for the last year.

Lots of things read:

Recent and current books:

Harry Potter books 1-4: I’ve never read these and am enjoying going through them with my kids

Venture Capital:

VCs are optimistic that AI investing will move beyond the hype in 2024

VCs anticipate more exits in 2024 but have no consensus on when or how

Other:

How Chase Plans to Revolutionize Rent Payments with a Digital Solution: 80%+ of tenant pay their rent by old-fashioned paper checks