Fintech Innovation Issue #3

Generative AI for personal finance management; AI gets some things wrong; Learning from Jamie Dimon; Personal Reading

Thank you for coming to Fintech Innovation where I do my best to describe fintech topics of interest to me, where I see future innovation opportunities, and other business related topics. Please consider subscribing or sharing with your friends as your support is very appreciated!

One Company:

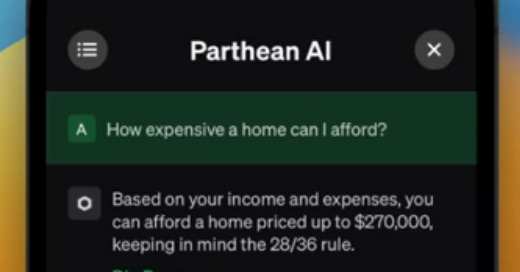

I recently came across Parthean even though they appear to have been around for a while. Last year, they raised a $1.1M round and at the time, they were using Plaid to enable customers to consolidate their financial picture into one place, present them with completely personalized financial health metrics accompanied by relevant financial education. Flash forward to the present and Parthean is now an AI company. They look to be leveraging ChatGPT to create a financial planner in your pocket. I have a couple of thoughts here:

Positive: Customers want very personalized advice. Historically, it’s only been available to customers that meet Asset Under Management minimums and/or are willing to pay for the service. To be able to ask a question and get a response that is completely unique to my financial situation is fantastic, but…..

Negative: Having been using multiple Generative AI platforms over the past few months I’ve realized that in the current state, you really need to be well versed in the subject matter that you’re asking about. I still feel that it’s ~80% accurate on matters that aren’t purely black or white. Combine this with the fact that I’ve had issues with aggregators not getting up to date balance information, I could see situations where I’m asking AI a question and it not having all of the facts on hand. AI is only as good as the data in and the models it is trained on and I think all of these things will improve over time (we’re still so early in the AI development that it feels incredibly unfair to judge) but I don’t want to have to question all financial advice.

Keep an eye on this space. I think the answer accuracy keeps getting better and better. As it does improve, the next step will be for the technology to prompt us instead of us having to prompt it. I still think that there will be a place for human interaction, with many customers still wanting to talk with a banker or a financial advisor before some decisions.

One fun thing:

Continuing with AI, I’ve been playing with various versions (e.g., ChatGPT, Notion AI, Bard, etc.) and have found them all to be useful for different tasks. For writing, they can extremely helpful with getting first drafts together. However, to get the best outputs you have to be skilled at creating the right prompts, be willing to continue drilling into a prompt to get it more precise, and also be decently well-versed in the content you’re asking about. It also sometimes doesn’t understand phrases or names for semi-common things. Example: I was just playing around and asked for a picture that illustrates the “sandwich” generation. Investopedia defines Sandwich Generation as: The sandwich generation refers to middle-aged adults (often in their 40s and 50s) who are caring for both elderly parents and their own children. Well I got something entirely different than intended with this prompt.

One thing learned:

Jamie Dimon went on Coffee with the The Greats by Miles Fisher (two years old but I just learned about it). It’s worth the listen. Here are some things that stood out to me.

Some people grow into a job and some people swell into a job. Don’t let that promotion go to your head, instead, recognize that you now have to work harder to keep learning and improving. Do this while maintaining humility. Dimon calls out the distinction in his mind between being humble and having humility, which he focuses on treating everyone equally and with fairness.

Writing his famous annual letter is important to him. Writing requires him to dig in further and understand all aspects of the business. I find this to be true for many things in life, writing requires a deeper level of understanding than just reading.

Biggest concern (outside of cybersecurity - which they spend $700M/yr on) is people! If you hire the wrong person you don’t know until 6-9 months later and then it will take another 6-9 months to replace them. That’s 18months of wasted time. What stands out to me here is that Dimon is not alone in this sentiment. What I’ve heard repeatedly in the Fintech startup world is that a founder should really spend ~90% of their time focused on their team. Dimon even speaks about it at one point that as your company grows, you need people around you that you can trust to make the right decisions. Here’s a great article about how Plaid approached this as just one example.

If Dimon taught a college course it would be about…. “How to think.” It would include how to make mistakes.

He talks a lot about morality, right and wrong, treating people the right way, and charity. But a lot about morality. Do things that are the right thing to do, even if they don’t help your business.

They even discuss sartorial preferences. His answer comes back to respect to who you’re meeting with. If he feels like he needs to wear a tie because it matters to the person he’s meeting with, he will. For JPMC employees, it’s manager discretion. But at the foundation, it’s about respect.

Dimon sends teddy bears to anyone he knows that has a baby and has done so for years.

Lots of things read:

4 Green Flags to Look for in a FinTech and its Management Team Before Signing a FinTech Partnership

WSJ: The Scientific Breakthrough That Could Make Batteries Last Longer

TechCrunch: Candidly picks up student debt relief where new US policies leave off

Finextra: BNPL platform Affirm quits Australia. I’ve never been big on BNPL and think that it’s risky for most individuals.

Techcrunch: Finch lands $40M to connect disparate HR systems with a single API